4+ dscr loan vs conventional loan

Maximum Loan Amount 75M. Small Business Administration SBA Acquisition Refinance and Renovation Loans.

Dscr Mortgage Loans Debt Service Cover Ratio

Interest rates and fees typically are higher on investment property loans.

. How Are Interest Rates Calculated. FHA 203k Loan MUST WATCH for ANY Renovation Loan Questions. Hard money loans from private investors come in with the highest interest rates on the market typically between 10 to 18 percent.

Minimum calculated DSCR vs. An SBA 7a loan may guarantee up to 85 percent of the loan amount if the mortgage is 150000. If youre applying for an SBA loan or conventional bank loan you should be prepared to provide even more bank statements.

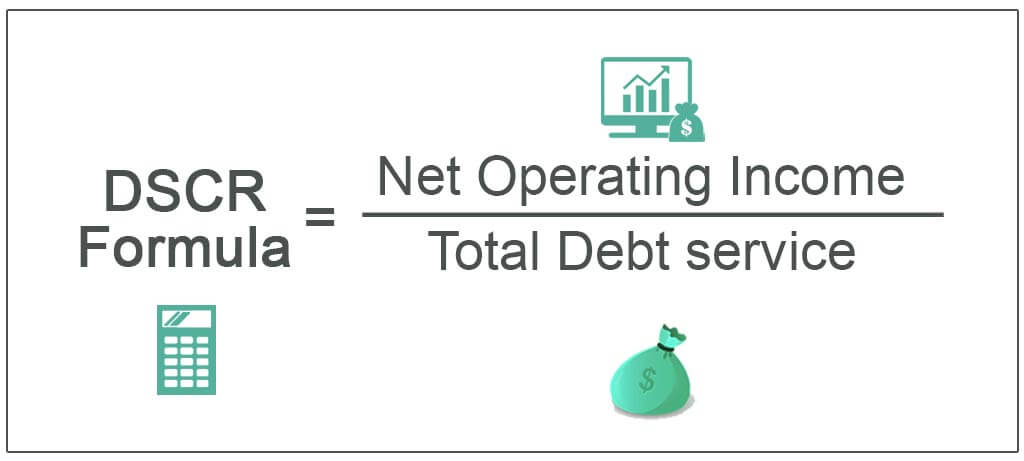

SBA 7a loans fully amortize and typically paid up to 25 years. What Is a Non-QM Loan. Debt Service Coverage Ratio DSCR DSCR is one of the most important indicators that lenders check.

This measures your ability to repay your debt. If your DSCR isnt high enough the lender may reject your. Personal and Business Tax Returns.

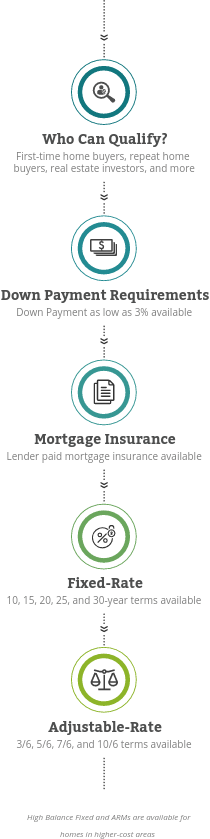

400 600 Equity bridge loan interest rate in percent 600 Minimum required DSCR multiple of debt service 130x. Adjustable Rate Mortgages ARMs and International 10-Year Fixed. So if a conventional mortgage is 45 an investment property loan on the same property to the same borrower would be 55 or more.

6ƒrP S ózT4ÓIBár òZ ßšópûCSÓ ØM ÏÅGrrŽ sjMyÄ Ã34 ÔÁ4bI4 2óšÅƒ äÀ HÔO Èe ÀÈÖDh  ÂX2YÙV- a- à fØ-YÌffp W524üJÉÊóò 5ðÆ. In other words the borrower can agree to hand over a certain amount of cash if the terms of the loan cannot be met. Additionally the term and amortization typically match on a residential loan ie.

Once youve secured your financing you are ready to start searching through listings. 90 of purchase 100 of rehab up to 75 ARV. This loan can be taken as fixed-rate mortgage a variable-rate mortgage or as a combination of the tow.

Clarifies that escrows are required for LTV85 unless restricted by state law on Expanded Access. A type of conventional loan a adjustable-rate mortgage is a type of mortgage in which the interest rate applied on the. Customers who complete 2 international money transfers will only need to pay a 495 delivery fee.

Griffin Funding is dedicated to delivering 5-Star Service a fully-digital easy-to-use experience and financial expertise. The next qualifier for conforming is the. 3030 whereas the term of a commercial loan is usually shorter than the amortization ie.

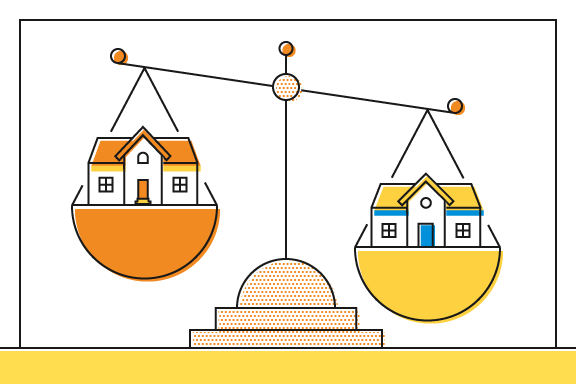

And this is simply for investors. A conventional loan is often difficult for Real Estate Investors to. LTV is the ratio of the loan amount to the appraised value of the underlying asset pledged as collateral for the loan LTV ratio.

Up to 80 LTV 30yr interest only rates start at 375. Updated Fannie Mae Conventional Products gift fund donor requirements. Approval for the 30-Year Rental Loan will occur if there is enough cash flow from the rental income received on a particular property to cover the outstanding monthly debt on the property.

A Debt-Service Coverage Ratio DSCR loan is based upon cash flow from rental income. The numbers dont lie folks. Cash can also be used as an asset to back a loan in the conventional sense.

Multifamily sellers originate loans for purchase by Freddie Mac as a part of our Optigo network of Conventional Seniors Housing and Targeted Affordable Housing correspondent lenders. Under the UKsCardcredit card because your card is a prepaiddebit Please note that there is a 1495 delivery fee for new customers. For regular homeowners it gets even worse the constraints are the net effective incomes which decreasing with inflation and whose.

You should expect them to be 100 to 400 basis points higher than on a conventional mortgage. 1099 loan programs allow these individuals to use there 1099 earning statements to qualify for a mortgage loan instead of using tax documents. RESIDENTIAL FIX FLIP BRRRR LOANS.

If using a non-conventional investor loan as mentioned above the investor would need to purchase for 291000 in order to cash flow the same. Griffin Funding is a mortgage lender that specializes in Bank Statement Loans for the self-employed DSCR Loans for real estate investors and VA Loans for veterans and active duty military. Conforming loans are loans that meet the Underwriting guidelines and requirements of FNMA Fannie Mae and FHLMC Freddie Mac.

1099 Income Loan Program Highlights. However this is a lot of information to. Bridge loan providers usually require a DSCR of 11 percent to 125.

Conventional bank loans offer fixed or variable interest rates typically between the 5 to 7 percent range. Rental Property Conventional Renovation Loans. Pdf SBL Update 01102020 loan submission template.

725 causing the borrower to have to refinance or payoff the loan or sell the property at or before the end of the loan term. A Non-QM loan or a non-qualified mortgage is a type of mortgage loan that allows you to qualify based on alternative methods instead of the traditional income verification required for most loans. The ratio illustrates your current debt and interest payments in relation to your current incoming cash flow.

311 -- Short-term loan - - Vay ngắn hạn 315 -- Long term loans due to date - - Nợ dài hạn đến hạn phải trả 333 -- Taxes and payable to state budget - - Thuế và các khoản phải nộp Nhà nước. Common examples include bank statements or using your assets as income. A basis point is a hundredth of a percent.

Hard money loans can be fixed or variable and have the shortest loan terms. So now lets talk about Conforming Loans. Fixed ARMs and Interest-Only.

DSCR is estimated by taking your propertys annual net operating income NOI and dividing it by the annual total debt service. Pipeline management tool programmatic exceptions credit risks dsr dscr guide bulletin year-end. P3 - Sources of funding and financing.

If you need a higher loan amount the SBA can guarantee up to 75 percent. A DSCR of less than one percent reveals a negative cash flow. Individuals that file W-9s run into issues qualifying for conventional mortgage loans.

Required DSCR alert - alert. If the FannieFreddie Shoe fits its a conforming loan. Our Cash-Flow DSCR investment loan offers unlimited properties no income no job Gift funds Appraisal Transfers and no minimum DSCR for loans greater than 150K.

Owner-Occupied 2nd Homes and Investment. Qualify with FICO and DSCR of the propertys. Commercial lenders generally look for DSCRs of at least 125 to ensure proper cash flow.

The various inputs. Up to 85 LTV. Even at a lower rate the lender receives a better risk-adjusted return.

Because of the more flexible qualification. Mortgage lending discrimination is illegal. A loan is first defined as either Government or Conventional.

With a bank statement loan also known as a stated income loanyou wont need to provide your lender with some of the typical financial documents needed for a mortgage such as W-2s and tax. The greater the DSCR the more likely that a lender will negotiate the loan rate. Estimate financial viability of conventional and P3 delivery for a highway project.

81oh1x2xlhzydm

Dscr Mortgage Loans Debt Service Cover Ratio

Investor Dscr Loan Nexa Mortgage

What Are Dscr Loans

Conventional Mortgage Loans Welcome Home Funding

Dscr Mortgage Loans Debt Service Cover Ratio

Understanding The Differences Between An Fha Loan And Conventional Loan Utah First Credit Unionutah First Credit Union

![]()

What Is A Dscr Loan Program

Dscr Mortgage Loans Debt Service Cover Ratio

Dscr Loan Program Mortgagedepot

Projection Based Dscr Loans Vs Traditional Dscr Rental Programs Youtube

What S Going On With Interest Rates For Dscr Loans Offermarket

Dscr Loans The Pros Requirements And How To Qualify

![]()

Dscr Loan Vs Conventional Loan

Dscr Mortgage Loans Debt Service Cover Ratio

Debt Service Coverage Ratio Loans Strategic Mortgage

Are Government Loans Hard Living In Dfw